The VAT in Liechtenstein is a tax applied to the delivery of goods and services. Liechtenstein and Switzerland have a common VAT policy, therefore the rules concerning the collection of the tax and the VAT rates are the same in the two countries. As such, the companies which are liable for VAT must register for a VAT number.

The rates of this tax will vary according to the type of services or goods delivered and some services are even fully tax exempt. The list below includes the main VAT rates in Liechtenstein:

– general rate: the general VAT rate in Liechtenstein is 7.7 percent and was reduced from 8%.

– first-grade reduction: 3.7 percent that only applies to those who provide lodging or accommodation services such as hotels in Liechtenstein.

– second-grade reduction: 2.5 percent applies to the supply of foodstuffs, medicine, newspapers, books, and magazines.

– total exemption: some goods are fully tax-exempt, such as education, banking, and insurance services as well as health services.

Our law firm in Liechtenstein can offer all needed assistance for VAT registration for your company.

Table of Contents

Main aspects concerning value added tax in Liechtenstein

The general VAT rate in Liechtenstein is 7.7%. However, the tax amount which is to be imposed on the Liechtenstein companies may vary according to the domain of business of each company. The enterprises which obtain profits from fields such as health, education, insurance are tax exempt.

According to the tax laws in Liechtenstein, there is also a reduced rate for the VAT, available for businesses which engage in the delivery of newspapers, books, food and drugs. This rate amounts to 2.5% of the business revenues. Another category of VAT reduction applies to businesses operating in the accommodation industry. Thus, the enterprise which gains from lodging will benefit from the reduced VAT rate of 3.7%.

Our lawyers in Liechtenstein remain at your disposition for further details regarding VAT rules in this country.

VAT registration for companies in Liechtenstein in 2021

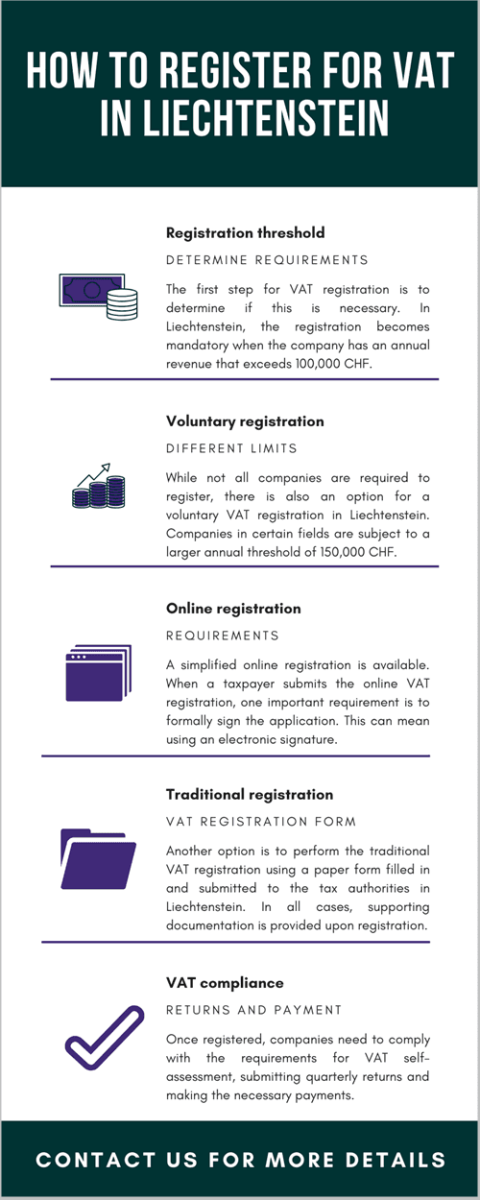

If you open a company in Liechtenstein and your revenues are less than 100,000 CHF, then VAT registration is not mandatory for you. However, the commercial laws give you the possibility to initiate a voluntary VAT registration, if you may find this option in your advantage.

If your income is above 100,000 CHF, then you must go through the VAT registration procedure which can be completed either through an online application or through filling the paper forms provided by the tax authority in Liechtenstein. If you are a foreign supplier, the authorities might also request a cash-deposit or a bank guarantee. Our lawyers recommend that non-registered businesses clarify their position in regards to VAT taxation. This helps companies avoid any unnecessary retrospective tax charges, which will also be charged at a per year interest rate.

A differed threshold applies to cultural associations, charitable institutions, and sporting associations. For these, the value of taxable supplies after which VAT registration is required is 150,000 CHF.

Investors should note that even though the business was registered for value-added tax purposes if can apply for an exemption if the turnover is lo longer reached.

The supply of goods and services that are covered by this indirect tax is broad and includes both the delivery of various goods and also of services that may or may not be subject to the place of business of the recipient. As stated above, foodstuffs, hotel and accommodation services, books and newspapers are subject to various rates, however, the categories also include, and are not limited to, construction work, repair and renovation work, personal consultancy services, travel agency services, passenger transport, architecture services, management services, and many others.

You can rely on us for details on how to obtain a VAT number in Liechtenstein in 2021.

VAT requirements in Liechtenstein in 2021

Registering a company that has recorded an income above the threshold is relatively simple, although foreign investors must remember that the submission forms are in German. There are two possible registration methods: Lilog in which the user logs in, fills in and then downloads the registration form, and Lisign in which the user logs in and performs the required operations that are then certified by means of a recognized signature.

The following details are important:

- signature: the Liechtenstein VAT registration form needs to be duly signed by the applicant; this can also mean using an electronic signature.

- data: investors who choose to file the registration form electronically will also need to enter any other relevant required data.

- verification: for electronic submissions, the applicant will also be asked to enter a 6-digit PIN as per the signature process.

- simple submission: an alternative is to fill in a simple the online form, print the document and then submit it to the authorities.

In an effort to aid the registration process, the authorities have also prepared a “Questionnaire for registration as a VAT payer for foreign companies”. The business representatives can answer the questions included in this form prior to commencing the registration procedure. The questions refer to the precise start date for the company activities, the type of business activities that will be carried out as well as the estimated annual turnover. Our lawyers can help you answer these questions.

If you have any question on the Liechtenstein VAT registration requirements for 2021, our lawyers can answer them.

The local tax authorities will check if the company has prerequisites for VAT obligations.

Companies that have a registered turnover below the threshold can also register voluntarily. This is advantageous for those businesses involved primarily in import and export activities, even though they do not reach the 100,000 CHF/year amount. Registration is recommended in these cases because input taxes can be asserted even though there is no VAT for exports.

The e-MWST Portal is used by VAT-registered companies to file the statements and make their submissions online. This is a free platform and it can be accessed by a company agent.

One of our lawyers who specialize in VAT registration in Liechtenstein can provide more information on the registration and the submissions for 2021. Please take note that companies that are not liable to value-added tax become so if they purchase services subject to acquisition tax of that with a value of more than 10,000 CHF per year.

VAT compliance in Liechtenstein

Value-added tax assessment in Liechtenstein is done on a self-assessment basis. This is why it is important for company directors to observe the ongoing reporting provisions. Failure to do so may result in them being held liable for the payment of the undue tax in case of unlawful payments or even VAT payment evasion. Non-established companies are required to assign a fiscal representative and one of our attorneys in Liechtenstein can help you during this step.

Companies in Liechtenstein are required to submit quarterly VAT returns. One of our lawyers is able to help you with detailed information about the legal requirements for VAT filing and payment as well as your obligations according to the annual revenues.

Taxation in Liechtenstein

Other taxes for companies in Liechtenstein include the following: the corporate income tax, the stamp duty, and real estate profit tax, social security contributions, customs duties, and import tariffs. Below, our tax lawyers in Liechtenstein list the values of the main taxes:

- 12.5%: this is the corporate income tax rate, one of the most advantageous in the EU.

- 1,800 CHF: this is the alternative minimum tax that can apply in some cases (except for small businesses).

- 12%: this is the tax on the remuneration paid to the director board members belonging to Liechtenstein companies; further conditions may apply.

- 1%: this is the stamp duty applicable in Liechtenstein, as it is part of Switzerland for the purpose of this tax.

The tax year in Liechtenstein is the same as the company’s accounting tear. Tax returns are to be filed by the 1st of July in the year following the one for which the tax liability occurs. The payment is to take place by August 31st the following tax year. Penalties apply for late filing or to those companies that do not observe the mandatory filing requirements.

Liechtenstein has concluded a number of double tax treaties with other jurisdictions. Their provisions can allow companies that have permanent establishments both in Liechtenstein and in another country to be taxed at a single source for a certain type of income. One of our lawyers can provide more information on these treaties as well as any other laws that are relevant to VAT registration in Liechtenstein and tax compliance in 2021.

Investments in Liechtenstein

Liechtenstein is the sixth smallest country in the world, according to area. Below, we present a set of statistical data that is relevant to the investment climate and the economic situation in the country:

- 4.156: companies in the services sector in 2018; a 3.6% growth compared to 2017.

- 623: companies in the production of goods sector, a 3.1% growth compared to 2017.

- 99: companies in the agricultural sector, a 4.2% rise compared to the number of companies in this sector in 2017.

Filing VAT returns in Liechtenstein in 2021

All companies collecting the value-added tax in Liechtenstein are required to file returns with the local tax office. VAT returns in Liechtenstein must be filed on a quarterly basis (every 4 months). At the same time, companies must also remit the amounts collected to the authorities.

In certain cases, exceptions can be made, and monthly VAT filings can be submitted.

It should be noted that the VAT can be claimed back by foreign citizens who have made a purchase in Liechtenstein. The refund can be given on taxable goods or services based on an invoice.

Changes announced on the VAT in Liechtenstein

According to recent announcements made by the Liechtenstein government, the standard VAT rate will be reduced starting with January 2018. The new rate will be 7.7% from the current 8%. The rate related to hotel services will also be lowered from 3.8% to 3.7%. However, the 2.5% VAT rate applicable to the supply of certain goods will remain unchanged.

Our lawyers in Liechtenstein can check whether you are liable for VAT and can further on assist you with your VAT registration in Liechtenstein. Please contact our local lawyers for any other additional information regarding VAT in this country.