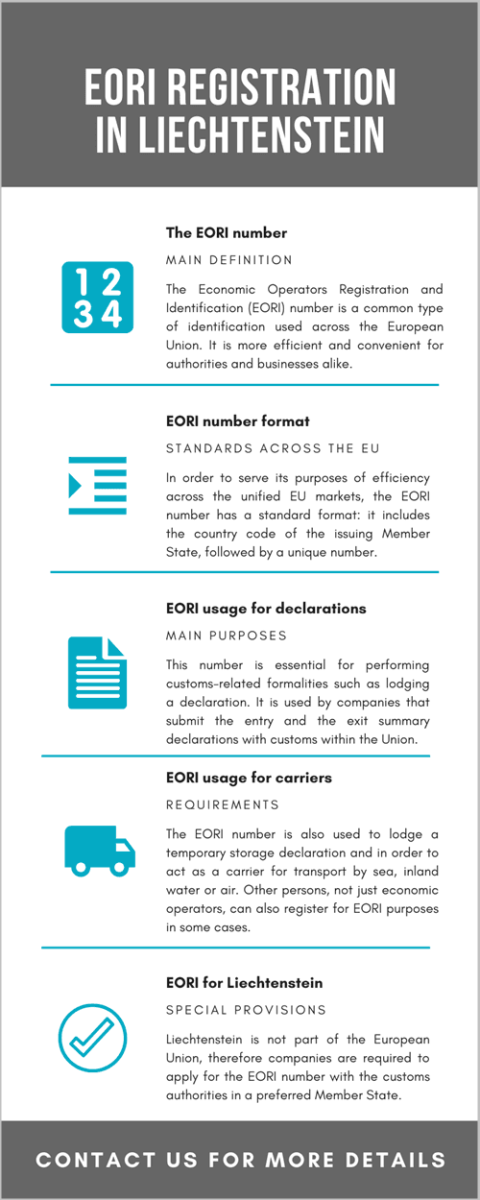

EORI registration in Liechtenstein simplifies in great amount the custom operations and communications for the merchandise traffic in this country. The EORI number stands for Economic Operator Registration and Identification and it consists of a code which allows identification of each economic operator that is in relation to custom administrations.

The EORI number is not only useful for streamlining the identification process across economic operators in the EU but it also allows for a greater degree of security in trading activities and clearer statistical data.

Companies in Liechtenstein fall under the category of economic operators that are not established in an EU country that can issue this number. However, it is important to note that these companies are also required to have this number in order to be able to lodge a set of statements with the customs when they do business in the territory of the Union. For this purpose, registration in another country is possible.

Requesting the services of our local law firm in Liechtenstein can be of great help in order to obtain as quickly as possible the EORI number and thus commence the trade activity of your company.

Table of Contents

How do companies register for the EORI number in 2021?

If you open a company in Liechtenstein and you intend to conduct activities covered by custom legislation, including importing in Liechtenstein or exportation from Liechtenstein to other states, then you should register for an EORI number. Liechtenstein shares a common customs area with Switzerland, a country that is not required to implement the EORI number on a national level.

EORI registration in 2021 is compulsory before any customs operation in a member state can effectively take place. A company in Liechtenstein will need to register for this number with an EU Member State. For example, it can register with the authorities responsible for assigning the EORI number in Austria, the Customs Office in Vienna, Innsbruck, Graz, Salzburg or other locations. When Austria is the chosen country with which the registration takes place, the following steps are relevant for the process:

- fill in the EORI application form: the trader (the Liechtenstein-based company) fills in the relevant data in the application form.

- send the form: the duly filled in form is then sent to the Customs Office for processing (this is done via an online portal)

- confirm: the authorities verify the application and if everything is in order, the trader will receive a notification containing the assigned EORI number.

- usage: the trader can then use the EORI number for trading purposes.

The application form is printed, filled in and signed. Because the company submitting the form is not registered in the Austrian business register, additional documents will be required.

Relying on one of our Liechtenstein lawyers would be most recommendable for the economic operators who intend to start the registration procedure for the obtaining of the EORI code in Liechtenstein.

Registration within only one EU Member State is required. If a Liechtenstein company chooses to register in Austria, it shall not repeat the process in another state.

In some cases, an “ad hoc” number may ve assigned by the customs administration for a certain declaration that is concerned. The customs authority may also choose to refuse this assignment, however, in any case, this number is not an EORI one and will not be introduced into the system.

The European Commission is the one that stores the EORI data at a central level and provides the needed infrastructure.

What is the importance of the EORI number in Liechtenstein?

The main advantage of the EORI number in 2021 is that it simplifies the identification process of different economic operators. It is unique and it offers to the authorities a quick access to details regarding the address of the company, the approvals that the economic operator has obtained from the customs and the trade relations it has with other companies.

The EORI code is required in the filing of import-export related documents and for custom verification. You can also check, by searching in the centralized database, the EORI codes, and subsequently information about other companies with which you intend to enter in a trade activity.

The following procedures are performed using an EORI number in 2021:

- submitting customs statements: economic operators use the number to lodge a customs declaration in the EU’s customs territory;

- submitting summary declarations: these are the entry and the exit summary declarations that are required in most cases when bringing goods into the territory of the Community;

- temporary storage: the number is also used by economic operators that require temporary storage within the customs territory of the Union and need to lodge a declaration for this purpose;

- acting as a carrier: for companies that act as carriers for transport by sea, inland water or air.

In some cases, economic operators are not the only ones that are required to register. Two other situations occur when such registration is mandatory within the Member State where the customs processes take place or when the EORI number is mandatory as provided by the EU customs legislation.

Don’t hesitate to reach out to our attorneys in Liechtenstein who are ready to offer you complete assistance in the obtaining of the EORI number for your company.

How can EORI numbers be verified in 2021?

The assigned EORI number for a Liechtenstein company can be verified within the EORI online database. When a company is entered into the central system for this assigned number, it provides certain data that includes the full name, the address of establishment or residence, the VAT identification number, the start date and the end date of the EORI. A consent to disclose the personal data is offered. The re-upload of the relevant documents shall take place as needed, whenever important changes occur for the economic operator.

Our lawyers in Liechtenstein can provide investors with complete details about the data that is collected on a mandatory basis for the purpose of assigning EORI numbers.

A customs authority is entitled to invalidate a number when the registered person makes this request directly to the authority or when the authority is aware that the company has ceased all and any activities that may have made the registration a mandatory one (for example, when the authority receives documents that the company has filed for bankruptcy and ceased its activity). If a company is to resume its activities, the EORI number will be required again and the old one that was initially assigned may be re-used.

Investments in Liechtenstein

Despite being a small state, Liechtenstein has a diverse economy that is dominated by small and medium-sized companies. The financial services sector is one of the most developed ones, accounting for 22.1% of the total value-added in 2017. Our lawyers in Liechtenstein present a set of data regarding the number of companies:

- 4,878: total number of registered companies across all business sectors in 2018;

- 4,710: the total number of companies in all business fields in 2017;

- 4,156: the number of companies in the services sector in 2018;

- 4,011: companies in the services sector in 2017.

For more information on doing business in Liechtenstein as well as EORI registration and other customs requirements please reach out to the experts at our law firm in Liechtenstein.